Capital Rotation, Policy Risk and Portfolio Construction

Invested In Us | Issue 11 | January 19, 2026

Markets entered the year with a more cautious tone. While headline equity indices remain resilient, leadership beneath the surface continues to shift—offering important signals for long-term allocators.

Below, we break down what we’re watching across capital markets, policy and economics, and how we think about portfolio construction in this environment.

State of Capital

U.S. equities were largely unchanged this week. The S&P 500, which represents the 500 largest publicly traded companies in the United States and where most everyday investors have exposure, finished the week roughly flat and is up just over 1% year-to-date.

Beneath the surface, leadership continues to rotate.

Industrials and metals are among the strongest performers, up over 8% year-to-date as of Friday’s close.

Energy has also outperformed, up nearly 7% year-to-date, supported by strong cash flows and disciplined capital spending.

Gold rose approximately 6.5% year-to-date, reflecting continued allocation by global central banks as geopolitical tensions rise and questions around U.S. policy stability resurface.

We view gold’s performance as notable. Central banks have been shifting toward precious metals for several years, and recent developments—including escalating tariff rhetoric involving NATO partners and renewed debate around Federal Reserve independence—have reinforced this trend.

Real assets more broadly continue to perform well. Historically, real assets have served as effective inflation hedges, as their value and cash flows are often linked to long-term contracts with built-in pricing escalators. This characteristic becomes particularly valuable during periods when growth-oriented equities—such as large-cap technology—lose momentum.

From an income perspective:

Real estate is currently yielding approximately 3.7%

Energy is yielding roughly 3.2%

By comparison, the S&P 500 dividend yield is near 1.2%

For investors seeking a combination of cash flow, downside protection, and long-term upside, these spreads are increasingly attractive.

Bond yields ticked higher this week amid concerns around potential political interference with monetary policy, renewed geopolitical tensions, and what markets have begun to frame as a broader “sell-America” trade. We are monitoring this closely, as further escalation could continue to benefit real assets—particularly precious metals.

Policy & Economics

Housing policy is once again moving to the center of the political debate.

The current administration has signaled potential price controls—an economic term referring to government-imposed ceilings or floors—by threatening to limit large institutional investors from acquiring single-family homes.

While we believe the intentions are well-meaning, particularly around improving affordability for individual buyers, we view this approach as populist policy that may produce unintended consequences.

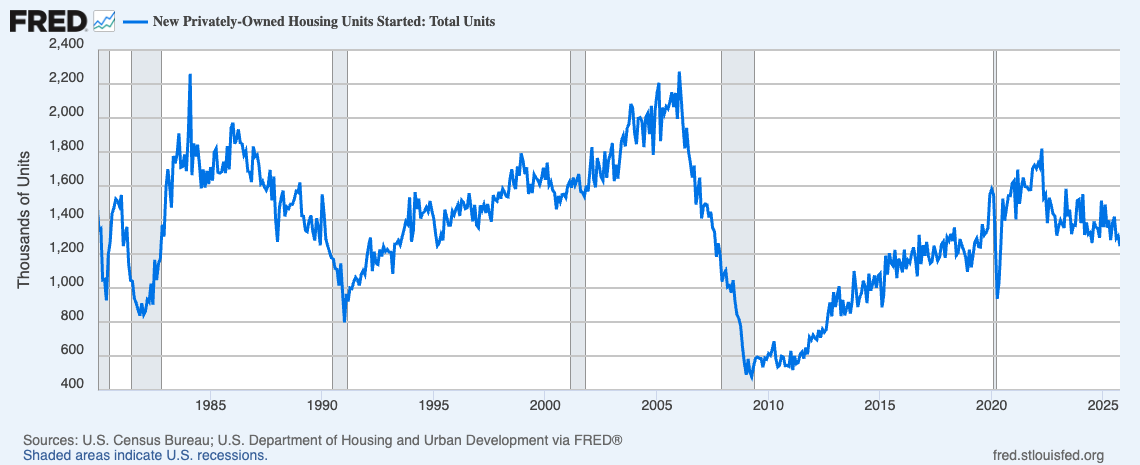

The fundamental issue in U.S. housing is supply, not demand.

Limiting institutional participation may reduce competition in certain markets in the short term. However, over the long term, it risks reducing the incentive to build new inventory, particularly in regions where development costs are already elevated.

Several structural factors continue to constrain housing supply:

High construction costs, driven by elevated prices for materials such as metals, lumber, and other commodities

Tariffs and supply-chain shifts, which raise input costs

Labor shortages, exacerbated by immigration policy and a shrinking skilled-trade workforce

Over-regulation, particularly in the Northeast, where zoning, permitting, environmental reviews, and public approvals can delay projects for years before revenue is generated

From a capital-allocation perspective, investors require the ability to earn a risk-adjusted return. When that becomes infeasible, capital moves elsewhere—and housing supply tightens further.

Most credible estimates suggest the U.S. is short 3 to 6 million housing units. In our view, long-term affordability will require policies that incentivize development, not discourage the investors with the balance sheets necessary to fund it.

The Breakdown: How We Think About Investing

When we think about investing, we generally divide the world into four core asset classes. This framework isn’t academic—it’s practical.

1. Cash (Short-Term Paper)

Cash includes anything that can be converted into liquidity in under roughly nine months.

Think:

Checking and savings accounts

Money market funds

Short-term CDs

Cash provides flexibility and safety, not growth. It’s about optionality and resilience.

2. Stocks (Equity Ownership)

Stocks represent ownership in a business.

If a lemonade stand has:

One owner → one share

One million owners → one million shares

When the business performs well, profits can be distributed or reinvested, increasing the value of each share. Stocks allow investors to participate in long-term growth.

3. Bonds (IOUs)

Bonds are loans.

If that same lemonade stand wants to grow without giving up ownership, it can borrow capital and promise:

Periodic interest payments

Repayment of principal

Bonds tend to offer more predictability, though typically with lower upside than equities.

4. Alternative Investments

This category includes assets outside traditional public markets.

Examples include:

Real estate

Private businesses

Private equity

Alternatives often emphasize long-term ownership and cash flow, with less day-to-day volatility—but also less liquidity.

The Conversation: Portfolio Construction

We believe a healthy portfolio includes a thoughtful mix of all four asset classes.

There is no universal allocation. The right structure depends on:

• Risk tolerance

• Time horizon

• Personal objectives and preferences

The objective is not perfection—it’s diversification, balance, and discipline.

Markets evolve. Policy shifts. Life changes.

A portfolio should be intentionally constructed, not reactively assembled.

Closing Thought

Markets remain investable, but the margin for error is narrowing. Leadership is rotating, policy risk is rising, and diversification matters more than momentum.

In environments like this, capital preservation and risk management are just as important as return generation.